- Knowledge Base

- Most Asked Magento-Related Questions

- How to configure tax calculation in Magento 2?

How to configure tax calculation in Magento 2?

Tax calculation is a time-consuming process if it is done manually. In Magento 2 you can set tax rate programmatically. Here you will find a step-by-step guide on how to set up tax calculation in Magento 2.

Step 1. Navigate to Stores > Settings > Configuration > Sales > Tax. There are several subsections in this section that you will need to fill out.

Step 2. The first is the Tax Classes section. In this section, use the system value for each option or customize them according to your needs:

Step 3. After that, complete the Calculation Settings:

You can use system values in this section too. The only option to which system settings cannot be applied is the Enable Cross Border Trade. All of these options are dropdowns, so if you want to change some parameters, you will just need to remove a tick from the needed setting and choose one of the shown options.

Step 4. Default Tax Destination Calculation is the next setting to configure. In this section, you need to define the Default Country and Default State(if default options are inappropriate for you) and specify the Default Post Code.

Step 5. Complete Price Display Settings. There are just 2 dropdown options in this section:

- Display Product Prices In Catalog

- Display Shipping Prices

Step 6. After that, complete the Shopping Cart Display Settings by selecting the appropriate options from the dropdowns if the default option does not suit your needs.

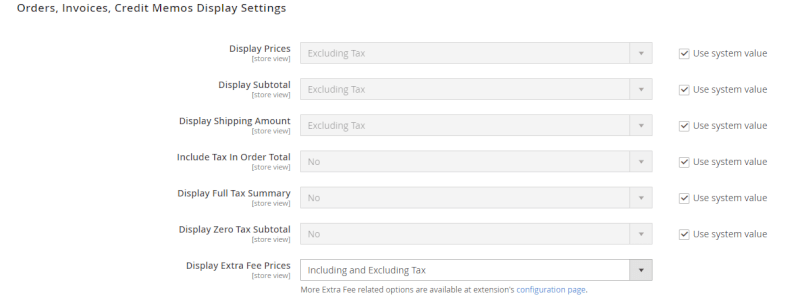

Step 7. Next comes the Orders, Invoices, Credit Memos Display Settings section. Like the previous one, it consists of several dropdowns, the system values of which you can change based on your needs:

Step 8. In the last section, you need to choose whether you want to Enable FPT or not. If you choose Yes, then several dropdowns will appear with a preset system value. If you want to change them, then uncheck the box and change the settings values.

Step 9. Save Config.

For a more convenient tax experience, you can use the Extra Fee extension, which will make it easy to calculate tax collections in accordance with local legislation.

Login and Registration Form