- Knowledge Base

- Most Asked Magento-Related Questions

- How to set up sales tax in Magento 2?

How to set up sales tax in Magento 2?

Magento 2 allows you to set up sales tax according to your country laws. Let’s see the basics.

→ Do you need to charge additional fees but are afraid of losing potential customers? Timely inform your customers about this with the Extra Fee extension. Offer additional services at the checkout and shopping cart.

Step 1. Log in to the admin panel and go to Stores > Settings > Configuration. If you have several sites, change the Store View to the needed option.

Step 2. Open the Sales tab and click Tax.

Step 3. In the Tax Classes section, specify the Tax Class for Shipping, Product, and Customer.

Step 4. Then, go to the Calculation Settings section.

Choose the base price for the calculation method from 3 options:

- Unit Price is a price of each separate product in the catalog;

- Row Total is the sum of all products in the cart minus discount;

- Total is the order total.

Step 5. In the Tax Calculation Based On field, specify what address will be the base for tax calculation: sipping, billing, or shipping origin.

Step 6. Next, choose if you need to include or exclude Tax from the catalog and shipping prices.

Step 7. In the Apply Customer Tax field, set up when you need to apply the tax After or Before Discount.

Step 8. Go to the Apply Discount on Prices line, and configure if discounts Include or Exclude tax.

Step 9. Choose if you need to Apply Tax On Customprice if available or Original price only.

Step 10. Enable or disable Cross-Border Trade.

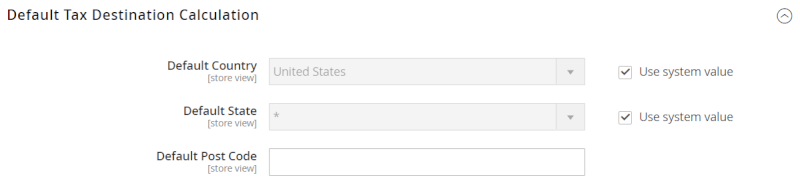

Step 11. Go to the Default Tax Destination Calculation section and configure the default tax country and state:

Step 12. Then if needed, you can change price display settings in the corresponding section. Check the detailed configurations in the official documentation.

Step 13. When ready, save the changes.

And that’s it. Now you know how to set up sales tax in Magento 2. Next, you can create tax rules, set up tax zones, and turn on VAT. If you doubt what settings are correct in your case, check the official guideline for your country.

Login and Registration Form